Click here to read the Spanish version.

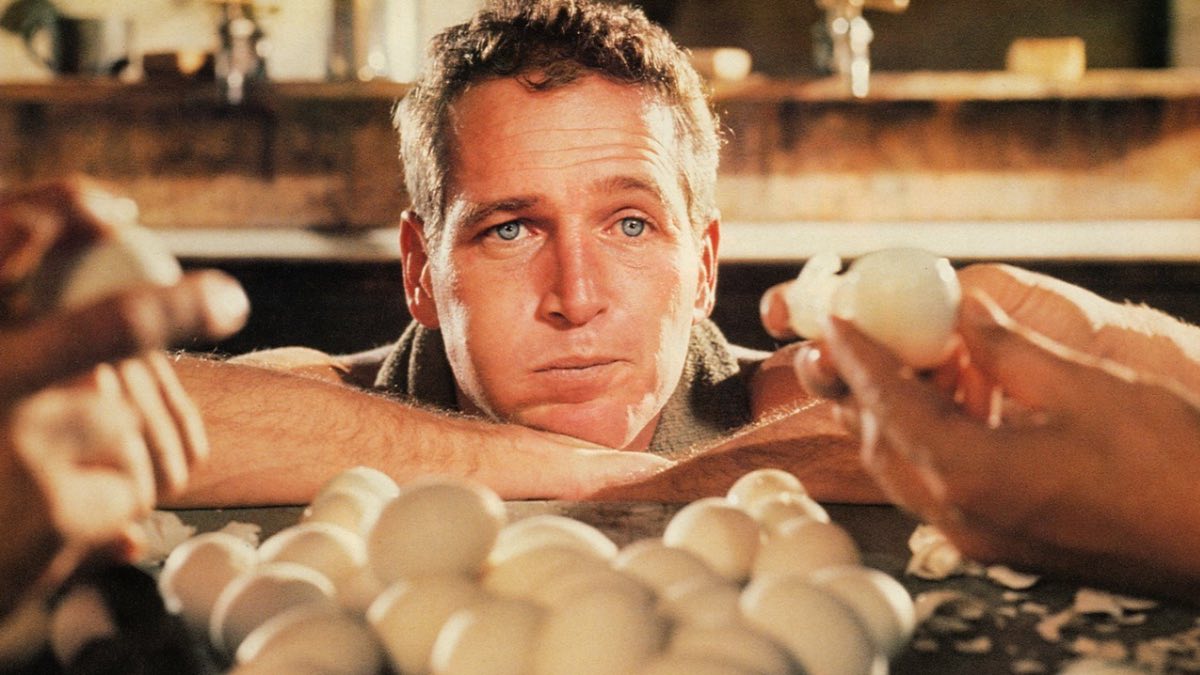

Cleo Capital and the other partners of Hevo Group have sold 100% of the shares to an investment company led by the founder and president of Granja Faria in Brazil. This is the Brazilian tycoon Ricardo Faria, known as ‘O Rei do Ovo’ in his home country, who has closed a deal with the venture capital firm to buy Hevo Group for 120 million euros.

Faria, who leads Brazil’s largest egg producer, with revenues of 1,858 million reais (around 303 million euros) and an ebitda of 646 million reais (105 million euros in 2023), is acquiring Hevo Group, the second largest egg producer in Spain after the consolidation of Dagu, Ous Roig, Granja Agas and Avicola Larrabe, according to market sources. The transaction is carried out in a personal capacity through an investment company domiciled in Europe, and not through Granja Faria.

The Brazilian, in turn, chairs Insolo, a company dedicated to soybean and corn cultivation, and the family office RCF Capital. In 2017, he sold Lavebras, the largest laundry in Latin America, to France’s Elis for 1.3 billion reais (€212 million at current exchange rates).

The sale to Ricardo Faria brings to an end Cleon Capital’s investment period in Hevo Group. The private equity firm, which controlled 90% of the capital, created the company from the acquisition and integration of Dagu, Ous Roig, Granja Agas and Avícola Larrabe. The sum of these companies formed a group with a production of more than 80 million dozen eggs per year and nearly four million hens, which places it only behind Huevos Guillén, the main supplier of eggs to Mercadona.

Hevo Group, in any case, also distributes in Mercadona, as well as in other large chains such as El Corte Inglés, Carrefour, Maro, Covirán, Coaliment, Eroski, Consum, Bon Preu, Dia and Condis.

The group’s directors Juan Gigante and Bienvenido Ríos are also leaving the shareholding as part of the operation with the sale of their 10% stake in the company, according to the sources consulted.

Dagu Expansion

Since Cleon Capital took control of Dagu in 2019, the company has tripled in size to reach revenues of €155m in 2023, up 25% from a year earlier, with a net profit of €7m, up from €3.5m the previous year.